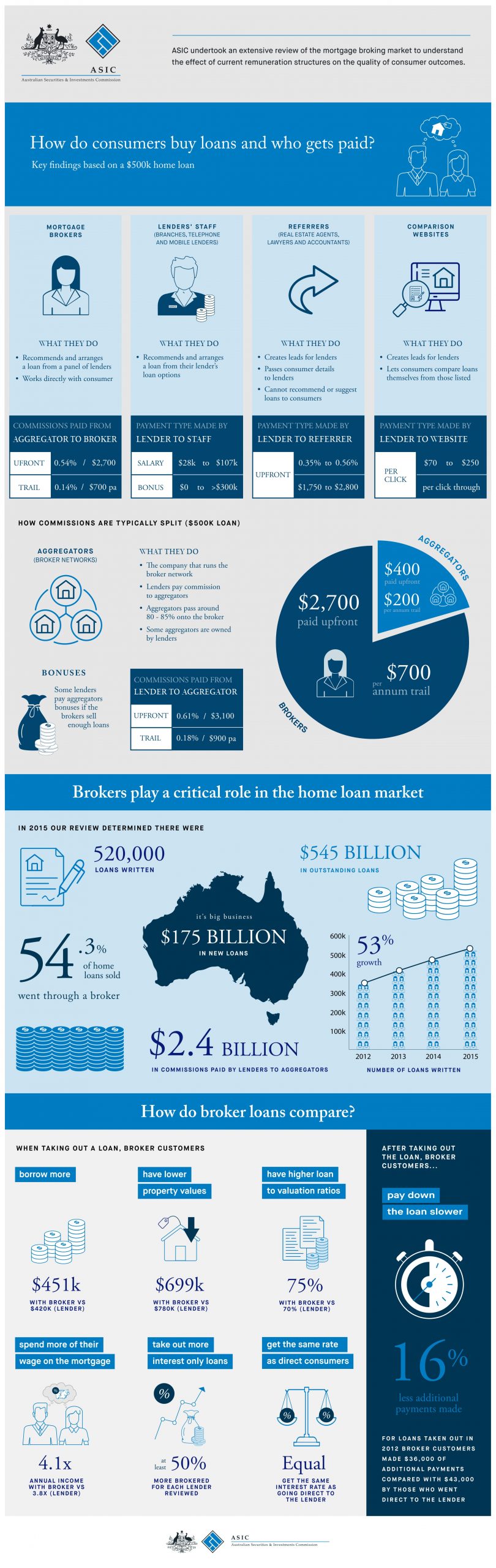

The Australian Securities & Investments Commission (ASIC) recently released an infographic to explain the regulator’s review of the mortgage broking market and understand the effect of current remuneration structures on the quality of consumer outcomes.

The review reveals that mortgage brokers are paid an average of 0.54% or $2,700 for a $500K home loan.

It also claims that when taking out a loan, customers who use mortgage brokers tend to borrow more, have lower property values, have higher loan to valuation ratios, spend more of their wage on the mortgage, take out more interest only loans, and get the same rate as direct customers.

It is interesting to take note that this review is based on home loans and not reverse mortgages. And at Seniors First, we believe that you can take advantage of great benefits when you choose to work with a reverse mortgage broker.

In fact, we have specified below the top four reasons why you should work with a broker when you are looking around for a reverse mortgage.

1. More Options to Choose From

A reverse mortgage broker like Seniors First works with the top providers of home equity loans, and our specialisation in providing this specific financial product allows us to offer you with more choices. Working with a reverse mortgage broker will allow you to explore more choices from various lenders.

2. Professional Advice

A simple online search will provide you with the top providers of reverse mortgage near your area. But with a professional broker to guide you, it will be easier to choose and apply for a loan package you need without going through the usual hassle. Reverse mortgage brokers have already established a good working relationship with home equity lenders, so they know the complexities of the process so you can be sure of a favourable result.

3. Save Valuable Time

A reverse mortgage loan is different than the usual home loan. Hence, you might need to spend some time studying its unique rules and terms before you finally decide to avail of an offer. You can save a lot of time if you work with a reverse mortgage broker who will explain to you the intricacies of the available products. On top of that, your broker will also take charge of filing your application and will regularly update you on the status of the loan.

4. Save Money

The ASIC review also noted that those who took home loans through brokers made 16% less additional payments. This is possible because brokers will always try to find you the lowest rates and fees so you can save more dollars.

For more information on how a reverse mortgage broker can help you with your home equity loan, you can call Seniors First on 1300 745 745 or send as an inquiry to info@seniorsfirst.com.au.