Our Reverse Mortgage broker team

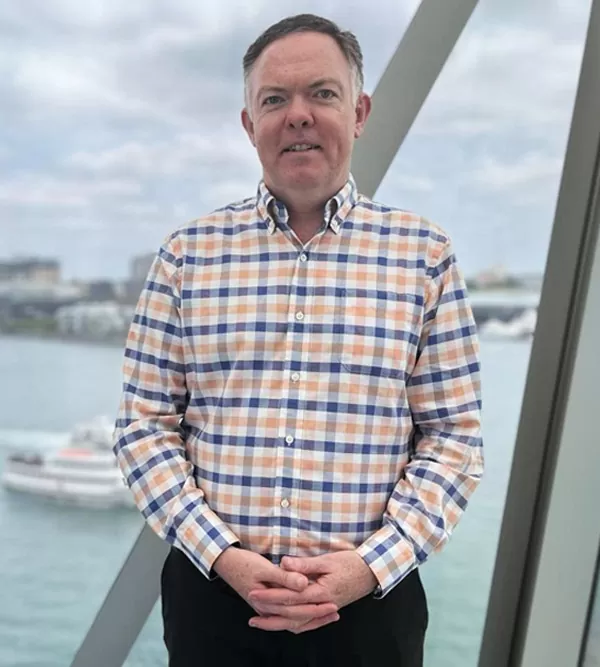

Darren Moffatt

Founder & Managing Director

“Even after all these years I still get a buzz out of helping people. Time and again, I’ve seen how releasing even just a tiny bit of home equity through a Reverse Mortgage can make a huge difference to someone’s life.”

Professional and licensed Reverse Mortgage brokers in Australia

Darren is an award-winning businessperson with almost two decades of lending experience.

He began his career in finance as a bank manager for Westpac in Sydney’s Inner West, before moving into corporate roles in mortgage insurance and non-bank lending with Royal & Sun Alliance and Challenger, respectively.

In 2005, Darren was appointed as the NSW state manager for a Reverse Mortgage lender with this was when he soon realised that there was a strong need for a mortgage broking service dedicated to reverse mortgages.

In 2006, he established Seniors First. The company quickly became an industry leader, and was recognised with awards in 2007, 2008 and 2009. Since then, Darren has often been invited to contribute to public policy forums and continues to appear regularly in the media.

Today, Darren is excited by the re-awakening of the Reverse Mortgage industry and the opportunities these new lenders and products offer to senior Australians.

As ever, he remains committed to serving their interests with responsible finance solutions that deliver a better retirement for Seniors First customers.

Elaine Kos

Area Manager

“When you retire your life doesn’t stop – you want the fun and enjoyment to continue. But this is often hard for people to achieve because all their money is locked up in the house. I love helping people access that money so they can have the wonderful retirement they deserve.”

Reverse Mortgage Broker

ACT, Canberra

Elaine is the longest-serving member of Seniors First staff, having been with the company since its launch in 2006.

She is a qualified reverse mortgage broker with ten years of lending experience and is one of the leading Reverse Mortgage lenders in Canberra and the ACT.

In addition to her work with Seniors First, Elaine is a successful business person in her own right.

She is well known for her activities as a business mentor, advisor, and former councillor of the Canberra Business Council.

In 2002, her abilities were recognised when she became one of the Telstra Business Woman of the Year finalists.

Today, Elaine continues to help other seniors, and remains a passionate believer in Reverse Mortgages and its power to transform lives for the better.

Andrew Cate

Reverse Mortgage Broker

“No two Reverse Mortgages are the same, and I work hard on tailoring each loan to best help the borrower. Helping people make an informed decision is vital, and showing borrowers which lender suits them best can make a difference both now, and years down the track.”

Reverse Mortgage Broker

Andrew is an accomplished Reverse Mortgage broker based in Sydney, NSW who also assists with Reverse Mortgages across NSW.

He has extensive experience in helping people over 55 release home equity to improve their retirement lifestyle.

Qualified in finance and mortgage broking, he has a detailed knowledge of the best Reverse mortgage lenders and interest rates.

Before joining Seniors First in 2014, Andrew was an established writer, and has run his own business for over 20 years.

He first became interested in Reverse Mortgages after seeing his father struggle to enjoy life on the age pension.

“Most people over the age of 55 didn’t grow up with compulsory super, and many will face financial challenges.

It’s enjoyable talking to people, getting to know what they need, and showing how a Reverse Mortgage can better their life."

Don Murdoch

Reverse Mortgage Broker

“I’m a big believer in the positive power of Reverse Mortgages, but they’re not for everyone. I always tell it straight and try to educate my clients on the pros and cons of the different options available. I love getting referrals from happy clients.”

Reverse Mortgage Broker

Don is a financial service professional based in Brisbane, Queensland.

Prior to joining Seniors First as a Reverse Mortgage Broker QLD, he had over 45 years of experience in financial planning and management.

Don has a history of keeping things simple and doing the right thing for clients.

Don’s first experience with Reverse Mortgages occurred in 2005 when his mother-in-law released some of her home equity.

Since then he has firmly believed in the product and the enormous difference a Reverse Mortgage can make to the lives of seniors in Queensland.

Bill James

Reverse Mortgage Broker

Reverse Mortgage Broker

Bill is the Reverse Mortgage Broker for Melbourne & Victoria. He is a qualified Chartered Accountant and an experienced finance professional.

Bill has worked in a variety of senior financial roles within the Public, Private and Not-for-profit sectors over the past 30 years and is looking forward to the challenge of assisting reverse mortgage clients within Victoria to improve their retirement lifestyle.

Angela Giokaris

Reverse Mortgage Broker

Reverse Mortgage Broker

Angela is a Sydney Based Mortgage Professional with over 10 years’ experience in Financial Services.

Angela took on a career change from commercial interior design to financial planning in 2011, with a focus on building long lasting client relationships.

During this time, Angela worked with all types of clients, especially those who were in retirement who strongly felt that leaving their family home would never an option for them.

For most, the common goal was to remain living close to family and friends whilst having the freedom to enjoy their hard-earned retirement with less financial stress.

Angela was challenged to find a suitable financial solution to help her clients. Once she understood the tangible benefits of Reverse Mortgages, Angela became passionate about providing in-depth knowledge on how Reverse Mortgages could improve their retirement lifestyle.

Angela is approachable and loves getting to know people while making the loan process as simple as possible for her clients, ensuring they have the best possible experience.

Outside of the office, Angela is busy with her husband and two teenage children and attempting to tick off her ever-growing list of restaurants to try.

Palka Kumar

Reverse Mortgage Broker

Reverse Mortgage Broker

Palka combines her passion for finance and customer service along with a professional approach to help people achieve their finance goals. She values her clients, working and guiding them throughout the process ensuring she meets their needs and objectives, keeping them well informed.

She holds a Diploma in Finance and Mortgage Broking and is a member with both the MFAA and the Australian Financial Complaints Authority.

Palka has been living in the South-eastern Suburbs of Melbourne for the past 11 years with her family. In her spare time, she loves spending quality time with her family, watching cricket, eating out, gardening, and socialising.

Greg Hendy

Reverse Mortgage Broker

Reverse Mortgage Broker

Greg has 44 years in the banking industry covering personal , business and rural banking and has worked all over Queensland .

He loves the ability to assist clients with their financial requirements that makes their life more rewarding or comfortable.

"Assisting people in an ethical and sustainable manner is the most fulfilling aspect of my career to date. Having had many requests for reverse mortgages in recent years and not having this option available previously makes the transition to Seniors First very attractive. The Reverse Mortgage product is highly regulated and much sought after in today's market."

Aside from a keen Tennis player, Greg has Diplomas in financial Advising and Financial Markets.

Greg has Diplomas in financial Advising and Financial Markets and looks forward to working with Seniors First.

Greg looks forward to assisting you with your reverse mortgage.

Dean Hukins

Reverse Mortgage Broker

Reverse Mortgage Broker

Dean is a highly skilled Mortgage Broker with extensive experience in owner-occupied, investment, and self-managed super fund (SMSF) lending. With a background in senior finance roles in commerce spanning over 25 years, he brings a wealth of knowledge and expertise to the table.

Dean holds a Commerce Degree and a Diploma in Finance & Mortgage Broking and is a member of both the Mortgage & Finance Association

of Australia (MFAA) and the Australian Financial Complaints Authority (AFCA).

In his interactions with clients, Dean is known for his caring and consultative approach. He takes the time to understand his clients' individual circumstances and financial goals and works closely with them to find the best mortgage solutions to meet their needs.

Outside of work, Dean is a dedicated family man who has lived with his loved ones in Sydney for over three decades. He enjoys spending time with his friends and family, including their cherished 11-year-old dog Shelley.

With Dean as your Mortgage Broker, you can expect a dedicated and knowledgeable professional who will work tirelessly to help you achieve your financial goals.

Richard Chapman

Reverse Mortgage Broker

Reverse Mortgage Broker

Richard is an accomplished Mortgage broker and Reverse Mortgage broker based in Brisbane, QLD.

Before joining Seniors First , Richard was an established broker, and has run his own business as well as working in-house for an accounting and financial planning practice.

He first became interested in Reverse Mortgages after seeing a friend's parents struggle to enjoy life on the age pension and assisting his own mother to restructure her retirement savings after his father passed two years ago.

Richard is looking forward to helping people over 55 release home equity to improve their retirement lifestyle.

“Most people over the age of 55 didn’t grow up with compulsory super, and many will face financial challenges. It’s enjoyable talking to people, getting to know what they need, and showing how a Reverse Mortgage line of credit can better their life."

Seema Baram

Reverse Mortgage Broker

Reverse Mortgage Broker

Seema is a Sydney based Mortgage Broker and comes with over 15 years of experience in Mortgage and Lending. She has worked with several finance companies and has also operated her own Mortgage and Finance business. She has experience in residential lending, personal loans, and asset finance.

Seema is professional and is very passionate in making sure that clients have a seamless experience with their financial journey and achieving their goals. She loves to ensure that clients are taken care of during the loan process and post settlement.

Outside of work, Seema enjoys spending time with her family, her dog and loves travelling. She is also a foodie and enjoys trying out different recipes.

Amisha Wall

Head of Operations

Head of Operations

Amisha is an experienced Operations Leader in Financial Services, with experience in home loans, personal loans, asset finance and credit card operations.

She is passionate about coaching and developing people and delivering results through people engagement, process improvement and building a high-performance culture.

Amisha has over 14 years’ experience working in the financial services industry and brings a wealth of industry knowledge.

Mia Cusack

Office Manager

Office Manager

Mia joined the Seniors First Team in a personal assistant position to our CEO Darren Moffatt.

Mia has come from a 13+ year administration and event management background, having organized wedding & corporate events for clients such as the Premier and Cabinet, Commonwealth Bank, Westpac, Mitsubishi Electric, Ernst and Young to name a few.

Mia is here to ensure a smooth workflow for the Seniors First team & to guarantee all our client’s requirements are met.

Angie Jerdee

Customer Engagement Consultant

Consultant

Angie’s professional background includes account management and customer service in a number of industries including travel and financial services. She also has experience as a small business owner providing hospitality supplies to restaurants, schools and aged care facilities.

Her most recent position was with the Commonwealth Bank working with the digital home lending team.

Her approach to providing excellent customer service has remained the same throughout her varied career. Angie is committed to ensuring each and every client’s individual needs are understood resulting in a positive experience.

Joan

Customer Engagement Consultant

Customer Engagement Consultant

Joan started her career as a Financial Consultant Specialist with Equifax, specializing in customer service and sales.

With her 7 years stint in the business, she had developed her career while radiating a positive attitude and tireless energy to encourage others to work hard and succeed around her workplace and get the best outcomes for her clients.

Meriam

Broker Support Officer

Broker support officer

Meriam is our Broker Support officer, with over 5 years of experience in the Australian Mortgage and Asset Finance industry.

Meriam is Certified for Lean Six Sigma Yellow Belt and Level IV Credit Management.

Meriam is an adrenaline junkie who likes art, fashion, nature and travelling. Approachable, cheerful, and has a positive outlook on life where she radiates to communicate well with her colleagues and clients.

Ronnie Amagsila

Broker Support Officer

Broker support officer

Ronnie is a highly experienced broker support officer with four years of expertise in the Australian mortgage industry. He holds a Diploma in Finance and Mortgage Broking, demonstrating his commitment to providing exceptional financial services to his clients.

Ronnie is well-known for his unwavering dedication to delivering the highest quality customer service, ensuring that his clients' needs are met with professionalism and efficiency.

In his free time, Ronnie enjoys spending quality time with his family, honing his guitar skills, and maintaining an active lifestyle through running. He also has a passion for traveling, which fuels his desire to explore new cultures and broaden his horizons.